Solar panels can lower your electricity bills by £1,300–£1,570 annually and help reduce reliance on the grid. Installation costs range from £3,800 to £12,200, with battery storage adding £2,500–£7,500. Thanks to the 0% VAT policy and grants like NISEP, upfront costs are reduced, with most systems breaking even in 6 years.

If upfront payment isn’t an option, financing options like green loans or payment plans allow you to spread costs. Combine these with government incentives for further savings. A 4kW system for a typical home costs £6,600–£8,100, with batteries available from £2,400 to £3,650.

Key steps:

- Check eligibility for grants (e.g., NISEP for low-income households).

- Use financing options like the Home Energy Upgrade Loan Scheme or EECO Energy payment plans.

- Calculate savings by estimating energy production and consumption.

For expert help, reach out to EECO Energy for a free quote.

What Home Solar Installations Cost

Understanding the upfront costs is key to selecting the right financing plan for your solar installation. Prices depend on system size, with domestic setups ranging from £3,800 (2kW) to £12,200 (6kW). For a medium-sized home, a 4kW system typically costs between £6,600 and £8,100.

Thanks to the 0% VAT policy introduced in May 2023, homeowners save around £1,000 compared to previous years. EECO Energy offers transparent pricing, making it easier to see the benefits of going solar.

EECO Energy Pricing Options

EECO Energy specialises in pricing tailored for south-facing roofs. Here’s an overview of their pricing structure:

| kW Rating | Number of Panels | Annual Output (kWh) | Price |

|---|---|---|---|

| 4.5kW | 10 | 3,380 | £3,950 |

| 5.4kW | 12 | 4,400 | £4,350 |

| 7.2kW | 16 | 6,189 | £4,850 |

| 8.1kW | 18 | 6,685 | £5,700 |

| 9kW | 20 | 7,099 | £5,900 |

These prices include everything you need for installation: panels, inverters, mounting equipment, and labour. A 4.5kW system is ideal for a three-bedroom home with average energy needs, while larger homes or those with higher electricity consumption may benefit from systems rated 7.2kW or higher.

Battery Storage Add-On Costs

Battery storage allows you to save surplus solar energy for use during the evening or on cloudy days, helping you reduce reliance on the grid. EECO Energy offers three 10kWh battery options to suit different budgets:

Installing a battery alongside your solar panels avoids additional labour and electrical work later. Although the Duracell option is the most expensive, it comes with the added benefit of EECO Energy’s status as a Duracell-approved installer, ensuring top-notch quality and warranty support.

Government Grants and Incentives

Northern Ireland provides several financial programmes to make installing solar panels more affordable. Two key initiatives are the Northern Ireland Sustainable Energy Programme (NISEP) and the 0% VAT policy.

Northern Ireland Sustainable Energy Programme (NISEP)

NISEP is funded by an annual collection of approximately £8 million from around 902,680 domestic and business electricity customers across Northern Ireland. The programme has been extended to run from April 2025 through to March 2027, with 80% of its funding directed towards supporting vulnerable customers.

For solar projects, NISEP offers grants covering up to 20% of the installation costs for both solar PV and solar thermal systems. These grants primarily aim to assist low-income and vulnerable households, although some funding is also available for businesses.

Keep in mind that you must wait for a formal grant offer before placing orders or beginning installation. Additionally, NISEP grants are not available for new-build properties. To apply, reach out to the Northern Ireland Energy Advice service or consult scheme managers like Power NI to confirm your eligibility for the 2025/26 funding cycle. They can also provide the official list of schemes offering solar grant contacts.

In addition to grants, fiscal policies further reduce the cost of solar installations.

0% VAT Policy on Solar Panels and Batteries

As of 1st May 2023, all solar panel and battery storage installations in Northern Ireland qualify for a 0% VAT rate. This benefit is applied automatically at the time of purchase, saving homeowners around £1,000 upfront and reducing the payback period by roughly one year. However, this relief is only available for "supply and install" packages, where the installer provides both the equipment and installation services.

Below is a summary of the key incentives:

| Incentive | Benefit | Eligibility |

|---|---|---|

| NISEP Grant | Up to 20% of installation cost | Low-income/vulnerable households & businesses |

| 0% VAT Policy | ~£1,000 upfront saving | All domestic homeowners |

| Smart Export Guarantee | Payment for excess energy | All solar owners with registered systems |

The 0% VAT policy can also be combined with the Smart Export Guarantee, enabling you to earn money by selling surplus electricity back to the grid.

Green Loans and Payment Plans

If paying the full cost upfront isn’t feasible, options like green loans and tailored payment plans can make solar panels more affordable. These financing solutions work alongside government incentives, allowing you to spread the cost over time. By balancing monthly repayments with the savings on your electricity bills, these options can significantly ease the financial burden. With grants, VAT savings, and flexible financing, the initial costs of solar panel installation can be reduced even further. Among the available choices are government-backed green loans and payment plans offered by EECO Energy.

Home Energy Upgrade Loan Scheme

The Home Energy Upgrade Loan Scheme is a government-backed initiative offering low-interest loans with an approximate 3% APR. You can borrow amounts ranging from £5,000 to £75,000, with repayment terms of up to 10 years. These loans are unsecured, meaning no charge is placed on your property. However, solar panels alone typically don’t qualify – your project must include a broader energy upgrade. At least 75% of the loan must fund other eligible measures, such as insulation or heat pumps. Additionally, your project needs to achieve a minimum 20% improvement in your home’s energy performance rating.

Participating lenders include AIB, Bank of Ireland, PTSB, and various credit unions. To access the scheme, you’ll need to work with an SEAI-registered professional who will oversee the project from start to finish.

Green loans like these allow you to spread the cost of upgrades over time, balancing repayments with your expected energy savings.

EECO Energy Payment Plans

For homeowners focusing solely on solar installations, EECO Energy offers a simpler alternative to green loans. Their payment plans are designed specifically for solar projects, letting you spread the cost of your system over time without the need for additional energy upgrades.

EECO Energy provides free surveys and quotes for domestic solar projects across Northern Ireland. These plans are unsecured and handled directly by EECO Energy, streamlining the process. Unlike green loans, these payment plans don’t require energy performance assessments or the involvement of registered coordinators. This means you can install solar panels as a standalone project without added complexity. For more details on system costs and battery storage options, refer to the EECO Energy Pricing Options section above.

sbb-itb-d2d975a

Calculating Savings and Payback Periods

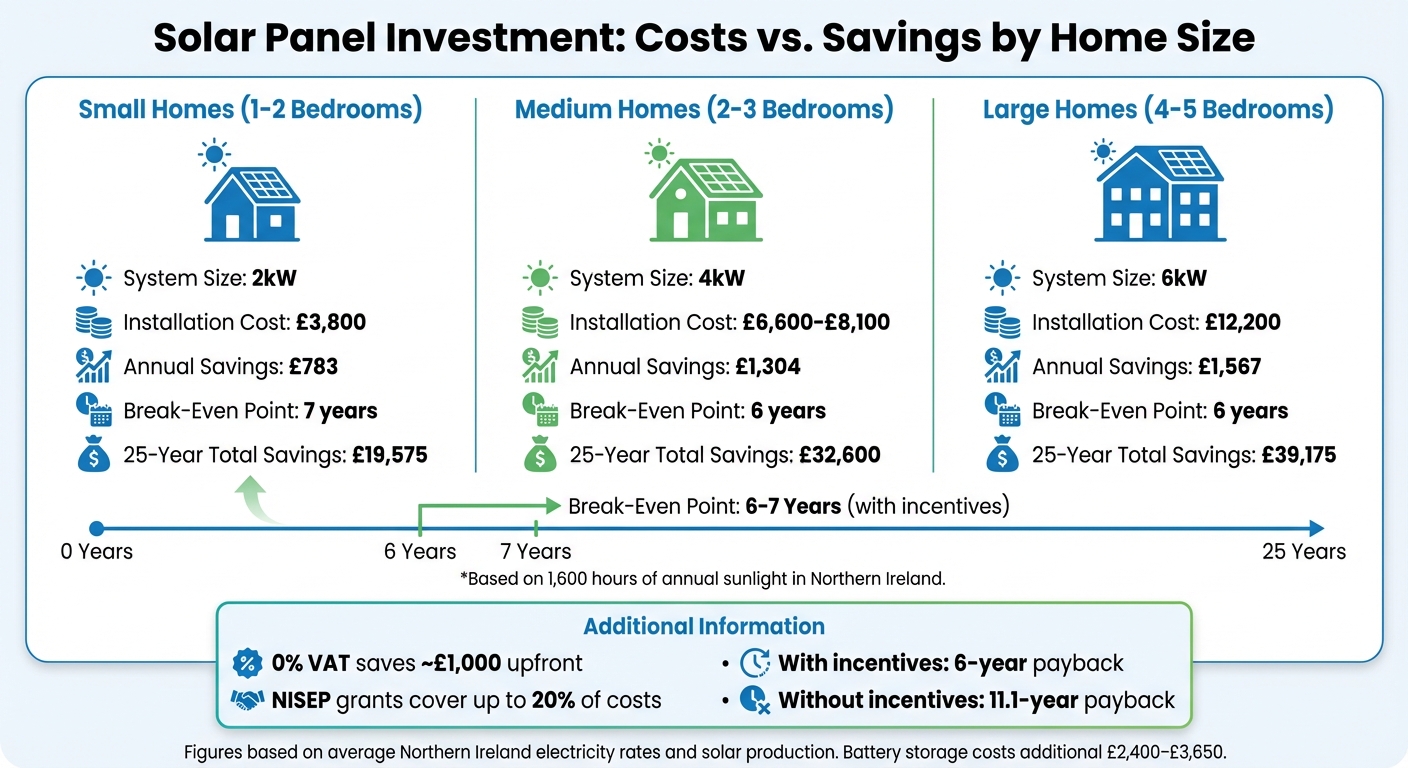

Solar Panel System Costs and Savings Comparison for Northern Ireland Homes

To figure out your potential returns, start by multiplying your solar system’s annual energy production by your self-consumption rate, then add any income from exporting surplus electricity. Northern Ireland enjoys around 1,600 hours of sunlight each year, which is enough for a 3kW–4kW solar system to power a medium-sized home effectively. This approach helps you estimate yearly savings and calculate how long it will take to recoup your investment.

Expected Bill Reductions and Return on Investment

For a medium-sized home in Northern Ireland, solar panels can reduce electricity bills by anywhere between £783 and £1,304 annually. Larger homes equipped with 6kW systems can save up to £1,567 per year. Over time, solar panels can slash energy costs by as much as 24% and provide free electricity for up to 25 years after reaching the break-even point.

Thanks to incentives, the payback period for a solar system can drop to about six years. Without grants, however, this period extends to roughly 11.1 years. To make the most of your solar system, use high-energy appliances during sunny periods or invest in solar battery storage to store excess energy for evening use.

| Home Size | System Size | Annual Savings | Break-Even Point |

|---|---|---|---|

| 1–2 Bedrooms | 2kW | £783 | 7 years |

| 2–3 Bedrooms | 4kW | £1,304 | 6 years |

| 4–5 Bedrooms | 6kW | £1,567 | 6 years |

How to Secure Financing for Your Solar Project

To secure financing for your solar project, you’ll need to confirm your eligibility, gather the necessary documents, evaluate if solar is worth it, and work with accredited installers. Below, you’ll find key steps to help you navigate the process and streamline your application.

Eligibility Checks and Application Timeline

Once you’ve identified financing options, the next step is confirming your eligibility. Start by checking your Energy Performance Certificate (EPC) rating. Most grants, including ECO4, are available only for properties rated between D and G. If you don’t have a copy of your EPC, you can request one from your estate agent or download it from the Government’s EPC register.

If you receive benefits like Universal Credit, Pension Credit, or Child Tax Credit – or if you face challenges due to age, health issues, or high energy bills – and your household income is under £30,000 annually, you may qualify for schemes like ECO4, the Warm Homes Grant, or the Home Upgrade Grant. To confirm eligibility, reach out directly to your energy supplier. A list of participating suppliers can be found on the Ofgem website. If you don’t receive benefits but are considered vulnerable because of age, health, or energy costs, check whether your local council’s LA Flex programme applies to you.

For those interested in NISEP schemes, you can download the annual scheme list from the Energy Saving Trust or the Utility Regulator website. Once you’ve identified the relevant programme, contact the scheme manager directly to begin your application. Keep in mind that you must wait for a formal grant offer before placing any orders or starting the installation process. After your eligibility is confirmed, installations are usually completed within a few weeks.

If your property is located in a conservation area or is a listed building, consult your local planning office. While planning permission is generally unnecessary for rooftop solar installations, it’s always a good idea to double-check to avoid unexpected delays.

Lastly, ensure your installer is accredited. For example, EECO Energy will handle the mandatory registration of your solar system with NIE Networks, ensuring you remain eligible for all applicable schemes.

To finalise the process, confirm any planning requirements and schedule your installation with a qualified installer.

Conclusion

Making the switch to solar energy in Northern Ireland doesn’t have to be complicated or expensive. With government-backed programmes and financial incentives, the initial costs can be significantly reduced. Plus, flexible payment options make it easier to manage expenses over time. If your property boasts a high EPC rating, you might even benefit from lower rates through options like green mortgages.

The key is finding a financing plan that aligns with your energy needs and property specifics. Take the time to review the eligibility criteria for the schemes covered in this guide to pinpoint the best fit for your situation. These support programmes can make a substantial difference in reducing the cost of installation.

With the Northern Ireland Sustainable Energy Programme (NISEP) extended until March 2027, support for solar projects remains accessible for the foreseeable future. This means that a variety of funding options are available to help make solar energy an achievable goal.

EECO Energy is ready to assist you every step of the way. From checking your eligibility and securing financing to completing your solar installation in just a few weeks, they’ve got you covered. You can reach them at 028 9592 2730 or via email at hello@eeco.energy for a free, no-obligation quote. Whether you’re considering a 4.5kW system starting at £3,950 or exploring solar panels and batteries options, EECO Energy will help you find the right solution.

Begin your journey towards energy independence – get in touch with EECO Energy today.

FAQs

Am I eligible for solar energy grants like NISEP in Northern Ireland?

To be eligible for solar energy grants like the Northern Ireland Sustainable Energy Programme (NISEP), there are a few key requirements you’ll need to meet. First, you must reside in Northern Ireland and be a homeowner, private tenant, or business owner. Your income also needs to fall within the specified thresholds. Importantly, if you’ve already received NISEP funding for the same type of installation, you won’t qualify again.

You’ll also need to provide some documentation, including proof of property ownership or tenancy and evidence of your income. Additionally, a building survey will be required to confirm your eligibility. Make sure to review these criteria carefully to see if you qualify – this could be your first step towards making solar energy a cost-effective option for your property.

What are the advantages of the 0% VAT policy for solar panel installations?

The 0% VAT policy plays a big role in cutting down the initial expense of installing solar panels, potentially saving homeowners around £1,000 upfront. This reduction in cost means you could see your investment pay off about a year sooner, making solar energy a much more appealing option for many households.

On top of that, the policy boosts affordability by offering annual savings of roughly £500 on electricity bills. These financial perks not only make solar panels a smart, budget-friendly choice but also encourage more people to embrace renewable energy – benefiting both your finances and the planet.

What are green loans and payment plans for solar panels, and how do they work?

Green loans are a great way to fund eco-friendly home improvements, such as installing solar panels. Offered by banks and building societies, these loans often come with reduced interest rates to encourage the use of renewable energy. Once you’re approved, the funds are either sent directly to you or to the installer, and you repay the loan in fixed monthly instalments over a set term, typically between 3 and 10 years. This approach helps spread out the upfront cost of solar panels, and in many cases, the savings on your energy bill can exceed the monthly repayments. Essentially, the system could start paying for itself from day one.

Another option available in Northern Ireland is payment plans offered by local solar installers. These usually involve a small deposit – often between £0 and £500 – followed by fixed monthly payments. These payments cover the cost of the panels, installation, and hardware, and they’re designed to be easy to budget for. Plus, many of these plans can be transferred to new homeowners if you decide to sell your property. Like green loans, the payments are often structured to be lower than the savings you’ll see on your electricity bills, making solar panels an affordable and practical choice.

To get started, request a quote from a solar installer and explore financing options with either your bank or the installer. In some cases, having a strong Energy Performance Certificate (EPC) rating might help you secure better loan terms. Both green loans and installer payment plans make the switch to solar energy more accessible, all while contributing to the UK’s goal of achieving net-zero emissions.