If you’re in Northern Ireland and considering solar panels, there’s good news: the VAT on solar installations is now 0%. This policy, effective since 1 May 2023, eliminates VAT on the supply and installation of solar panels for homes and charitable buildings. Here’s what you need to know:

- Savings: A typical 3.5 kWp system now costs around £7,026 instead of £7,860 (under the previous 5% VAT rate), saving you approximately £834 upfront.

- Eligibility: Applies to residential properties and buildings used for charitable purposes. Commercial properties and DIY installations are excluded.

- Installer Requirements: The system must be supplied and installed by the same VAT-registered, MCS-certified company.

- End Date: The 0% VAT rate ends on 31 March 2027, reverting to 5% from 1 April 2027.

- Expanded Coverage: Since February 2024, standalone battery storage systems are also VAT-free.

This initiative simplifies the process, reduces costs, and shortens the payback period for solar investments. Combine this with schemes like the Smart Export Guarantee to maximise your savings. Act before the 2027 deadline to make the most of this opportunity.

How the 0% VAT Policy Works

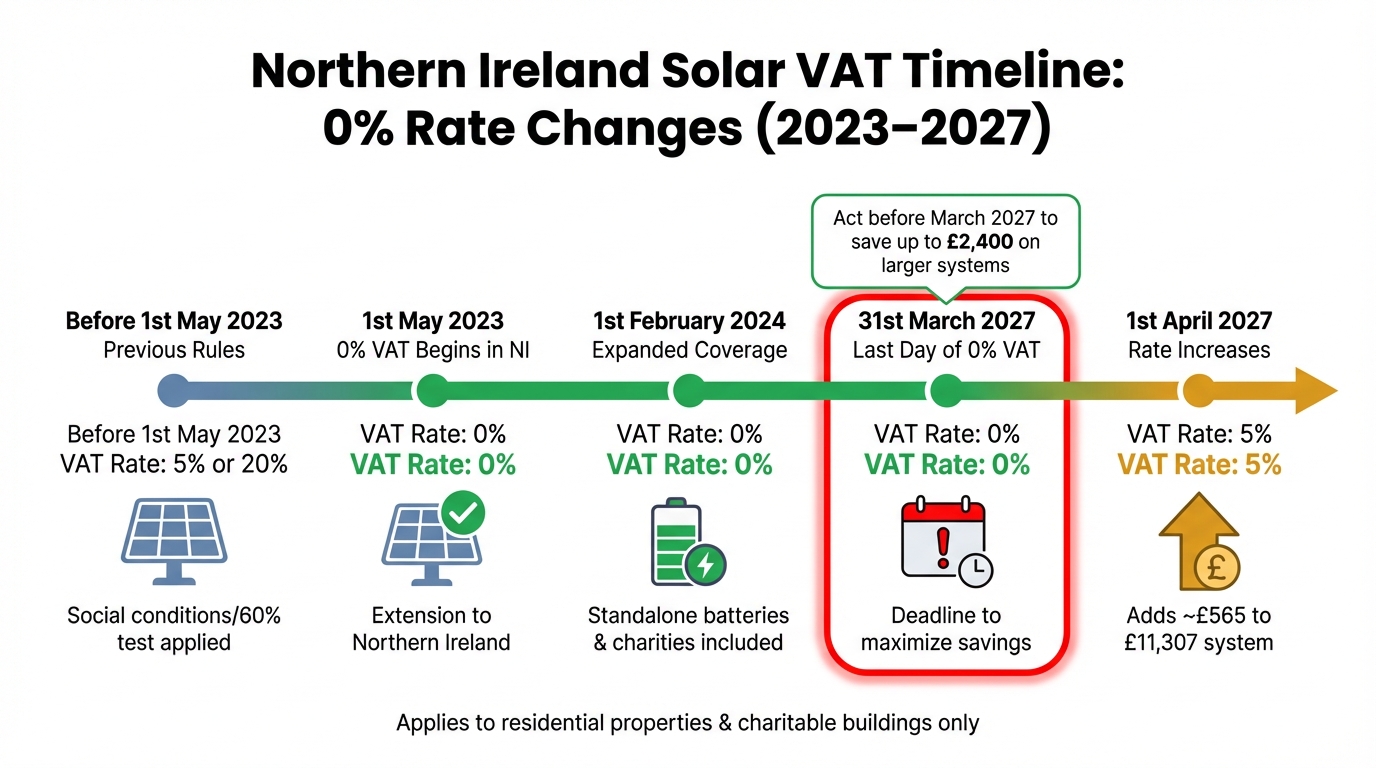

Northern Ireland 0% VAT Solar Panel Relief Timeline 2023-2027

The 0% VAT relief is applied automatically by your installer – no extra forms, no waiting around. There’s no need to submit a separate application to HMRC. If your installation meets the eligibility requirements, the zero rate will appear directly on your final invoice.

This simplified system replaces the older, more complicated process. However, there’s one key condition: the same company must both supply and install your solar equipment. If you purchase the panels from one retailer and hire a separate installer, the standard 20% VAT rate will likely apply to the equipment purchase. This "supply and install" rule ensures the VAT relief applies to the entire system. Let’s explore the timeline and changes to this policy in more detail.

Policy Timeline and End Date

The 0% VAT relief is running on a fixed schedule. It was introduced in Great Britain on 1st April 2022 and extended to Northern Ireland on 1st May 2023. The policy will remain in place until 31st March 2027.

After this date, the VAT rate won’t jump back to the standard 20%. Instead, it will shift to a reduced rate of 5% starting on 1st April 2027. To put this into perspective, for a solar system costing £11,307, the rate change would add around £565 to the overall cost.

| Date | Policy Change | VAT Rate (NI Residential) |

|---|---|---|

| Before 1st May 2023 | Previous rules (social conditions/60% test) | 5% or 20% |

| 1st May 2023 | Extension of 0% VAT to Northern Ireland | 0% |

| 1st February 2024 | Inclusion of standalone batteries and charities | 0% |

| 31st March 2027 | Scheduled end of 0% VAT policy | 0% |

| 1st April 2027 | Reversion to reduced rate | 5% |

Now, let’s break down the eligibility requirements for this VAT relief.

Eligibility Requirements

To benefit from the 0% VAT rate, your installation must meet certain conditions. The type of property is crucial: the relief only applies to residential properties (such as houses, flats, care homes, hospices, houseboats, and static caravans) and buildings used exclusively for charitable purposes, like village halls. Commercial properties, hospitals, and prisons remain subject to the standard 20% VAT rate.

Your installer must be both VAT-registered and professionally certified. Most eligible installers hold Microgeneration Certification Scheme (MCS) accreditation, which ensures compliance with industry standards and is often required for accessing other financial incentives. The responsibility for applying the correct VAT rate lies with the installer, so it’s important to confirm their credentials before moving forward.

Since February 2024, the relief has also extended to standalone battery storage. This applies whether the batteries are added to an existing system or installed independently.

Products and Systems Covered by 0% VAT

The 0% VAT relief applies to a wide range of solar equipment and installation services. Here’s a breakdown of what’s included and what’s not.

What’s Included

If you’re planning to install solar PV systems, you’re in luck. This relief covers everything from solar panels to cabling, AC/DC inverters, control panels, and mounting hardware. For those interested in solar thermal systems to heat water, the scheme also includes evacuated tube or flat plate collectors, pipework, pumps, storage cylinders, and heat exchangers.

From 1st February 2024, battery storage systems are eligible too – whether they’re added to a new or existing setup or installed as standalone units. The relief also extends to ancillary equipment, such as solar diverters (which redirect surplus energy to heat water) and energy management systems, as long as they’re part of the installation.

Importantly, the relief isn’t just limited to the equipment itself. Installation labour is also VAT-free, provided the same MCS-certified company supplies and installs the system. Even additional work, like creating a new loft hatch to access your roof, qualifies for 0% VAT if it’s necessary for the installation.

What’s Not Included

Not everything fits under the 0% VAT umbrella. Items like EV chargers and smart thermostats are excluded, as they don’t meet the government’s criteria for energy-saving materials. If you purchase equipment from separate suppliers, the standard 20% VAT will apply to the products themselves, though the installation labour may still qualify for 0% VAT.

DIY installations are another no-go. If you buy and fit the system yourself, you won’t be able to claim the relief.

Additionally, the scheme is limited to specific property types. Commercial properties, hospitals, and prisons are not eligible and remain subject to the standard 20% VAT rate. The relief is reserved for residential homes and buildings used exclusively for charitable purposes.

How Much You Can Save

The 0% VAT policy mentioned earlier offers homeowners a noticeable reduction in installation costs. By removing VAT on eligible systems, it significantly lowers upfront expenses. For instance, installing a typical 3.5 kWp solar PV system for a three-bedroom home now costs roughly £7,026 under the 0% VAT rate. This is a clear saving compared to the previous 5% VAT scheme, where the same system would have cost around £7,860 – saving you about £834. Below is a breakdown of how savings vary with different system sizes.

Savings by System Size

Here’s a table showing how savings increase with system costs:

| System Cost (Excl. VAT) | Total Cost at 20% VAT | Total Cost at 5% VAT | Total Cost at 0% VAT | Saving (vs 20% VAT) |

|---|---|---|---|---|

| £4,000 | £4,800 | £4,200 | £4,000 | £800 |

| £7,000 | £8,400 | £7,350 | £7,000 | £1,400 |

| £10,000 | £12,000 | £10,500 | £10,000 | £2,000 |

| £12,000 | £14,400 | £12,600 | £12,000 | £2,400 |

The larger the system, the greater the savings. For example, a £10,000 residential solar installation can save you about £2,000 compared to the 20% VAT rate. If you opt for a £12,000 system with battery storage, the savings jump to approximately £2,400. These upfront reductions not only lower your initial costs but can also shave about a year off your payback period, allowing you to see returns on your investment sooner.

Additionally, solar panels can cut your electricity bills by over 50%. Many homeowners save around £500 annually. Combine this with income from the Smart Export Guarantee, and you’re looking at both immediate and long-term financial benefits.

sbb-itb-d2d975a

Using 0% VAT with Other Financial Support

The 0% VAT relief works seamlessly alongside other financial incentives, helping to cut costs and shorten the time it takes to see returns on your investment. By combining reduced upfront expenses with ongoing income streams, many homeowners find their payback period is typically between 6 and 10 years.

The trick lies in understanding how these incentives interact. While the 0% VAT benefit lowers your initial installation costs, programmes like the Smart Export Guarantee (SEG) provide a steady income by paying you for any surplus energy your system generates. To take advantage of both, you’ll need to ensure your solar system is installed by an MCS-certified professional. Together, these schemes create a strong foundation for savings, which are explored further below.

Smart Export Guarantee (SEG) Scheme

The Smart Export Guarantee rewards you for exporting excess solar energy back to the grid. While the 0% VAT relief reduces your upfront installation costs, SEG offers consistent earnings over time. This pairing is especially effective because the reduced initial expense means you’ll start seeing financial returns much sooner.

To qualify for the SEG scheme, you’ll need a smart meter to monitor the electricity you export. Additionally, your solar system must meet the MCS certification standards required for VAT relief. If you decide to include battery storage, here’s some good news: as of February 2024, the 0% VAT rate will also apply to standalone or retrofitted batteries. This means you can store energy and sell it back to the grid during peak pricing periods, helping you maximise your SEG earnings. Other initiatives, such as the Northern Ireland Sustainable Energy Programme (NISEP), can further boost the financial benefits of your solar investment.

Northern Ireland Sustainable Energy Programme (NISEP)

For businesses in Northern Ireland, NISEP provides grants that cover up to 20% of solar installation costs during the 2024/2025 funding cycle. However, it’s worth noting that commercial properties are subject to the standard 20% VAT rate. While this means businesses don’t benefit from the VAT exemption available to residential properties, NISEP funding still offers a valuable way to reduce costs.

Currently, homeowners in Northern Ireland don’t have access to domestic-specific grants, making the 0% VAT relief the primary way to save on solar installations. Businesses looking to take advantage of NISEP should register via the Solar NI website to secure their funding allocation. This programme focuses specifically on green technologies, making it a worthwhile addition to your solar investment, even with the VAT distinction.

Conclusion

The introduction of 0% VAT on solar installations offers a significant reduction in upfront costs for homeowners in Northern Ireland – saving approximately £1,000 – and trims the payback period by about a year. However, this reduced VAT rate is only available until 31 March 2027, after which it reverts to 5% VAT. The earlier examples showcased how these savings can vary depending on the size of the solar system installed.

To qualify, the system must be both supplied and installed by the same MCS-certified provider, and the property must be residential or charitable. These straightforward eligibility criteria make solar energy an even more attractive option, highlighting its dual benefits of cutting costs and lowering carbon emissions.

Government officials have reinforced this sentiment:

"This measure underlines the government’s commitment to help households to save money on their energy bills and reduce their carbon footprint and contribute positively to our national climate change targets." – Michael McGrath, Minister for Finance

When paired with schemes like the Smart Export Guarantee, the financial advantages of solar energy become even clearer. Homeowners can see electricity bill reductions often exceeding 50%, with system prices starting from around £4,999. Acting before the March 2027 deadline ensures you fully benefit from this temporary tax relief and maximise the return on your solar investment.

FAQs

What will happen to the VAT rate for solar panel installations after 31 March 2027?

From 1 April 2027, the VAT rate for solar panel installations will no longer be 0%. Instead, it will revert to a reduced rate of 5%, which remains lower than the standard VAT rate but could increase the overall cost of installations.

For homeowners and businesses thinking about switching to solar energy, this means there’s a window of opportunity to save. By completing installations before 31 March 2027, you can still benefit from the current 0% VAT rate and reduce your upfront costs.

Can I still qualify for 0% VAT if I buy solar panels separately and hire an installer?

No, 0% VAT relief applies only when the same company both supplies and installs the solar panels. If you buy the panels separately and then hire a different installer, the installation won’t qualify for the zero-rate VAT. To take advantage of this incentive, make sure your installer also supplies the panels as part of their service.

How does the 0% VAT relief work alongside the Smart Export Guarantee (SEG)?

The 0% VAT relief on solar panel and battery storage installations offers a great way to cut down on upfront costs for homeowners. Importantly, this relief has no impact on your eligibility for the Smart Export Guarantee (SEG). The SEG is a government programme that compensates households for the renewable electricity they send back to the grid, regardless of how the system was paid for or whether the 0% VAT rate was applied.

In essence, you can take advantage of both benefits: the VAT relief reduces the initial cost of installation, while the SEG provides ongoing payments for the electricity you generate and export. These two incentives work independently but complement each other, making solar panel installations both more accessible and financially worthwhile. The 0% VAT rate is available until 31 March 2027, and the SEG will continue for as long as the scheme is active.